IAB、2015年の米国ネット広告市場レポートを公開 -20%増加の596億ドルへ-

Q4 2015 Reached $17.4 Billion, Rising 23% Over Same Period in 2014

Mobile Advertising Climbs to $20.7 Billion in 2015, a 66% Upswing Year-Over-Year; Digital Video Increases 30% to $4.2 Billion

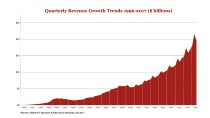

U.S. digital advertising revenues reached an all-time high of $59.6 billion in 2015, according to the full-year IAB Internet Advertising Revenue Report, released today by the Interactive Advertising Bureau (IAB) and prepared by PwC US. This marks a 20 percent surge over the earlier record-breaking 2014 revenues of $49.5 billion – and represents the sixth year in a row of double-digit growth for the industry. In addition, the report shows that 2015’s fourth-quarter numbers reached $17.4 billion, a 23 percent increase from $14.2 billion in Q4 2014, and an 18 percent increase from the $14.7 billion in 2015’s third-quarter.

Other highlights include:

- Mobile advertising skyrocketed to $20.7 billion during FY 2015, a 66 percent hike over the 2014 total of $12.5 billion

- Digital video (non-mobile), a component of display-related advertising, reached $4.2 billion in 2015, a 30 percent rise over $3.3 billion in 2014

- Social media advertising brought in $10.9 billion in 2015, up 55 percent over 2014’s $7 billion

- Search (non-mobile) revenues reached $20.5 billion in 2015, up 8 percent from $19 billion in 2014

- Display-related advertising (non-mobile) revenues in 2015 totaled $13.9 billion, representing 23 percent of the year’s revenues, an uptick of 3 percent over $13.5 billion in 2014

- Retail advertisers continue to represent the largest category of internet ad spending, responsible for 22 percent last year, followed by automotive and financial services which each accounted for 13 percent of the year’s revenues

“Mobile’s impressive upswing is a testament to its increasing importance to marketers,” said Randall Rothenberg, President and CEO, IAB. “Digital video is also seeing strong growth, and we anticipate brands and media buyers will drive further excitement about the future of the medium at the upcoming Digital Content NewFronts.”

“Internet advertising was a disruptive innovation when the industry was formed,” said David Silverman, partner, PwC US. “Twenty years later we still see double-digit growth rates, including 20 percent in 2015. Three key disruptive trends – mobile, social, and programmatic – continue to fuel this exceptional rate of growth.”

“There is no question that interactive screens are attracting consumers and the advertisers that want to reach them where they live – increasingly on mobile devices,” said Sherrill Mane, Senior Vice President, Research, Analytics, and Measurement, IAB.

Here are the results from the full-year in comparison with last year’s numbers:

IAB 2015 Full Year Report – Press Release

Comparison of 2015 and 2014 Data

(in millions)

| Full Year 2014 |

Full Year 2015 |

|||

| % | $ | % | $ | |

| Revenue (Ad Formats) | ||||

| Search | 38% | $18,955 | 34% | $20,481 |

| Classifieds and Directories | 5% | $2,690 | 5% | $2,757 |

| Lead Generation | 4% | $1,866 | 3% | $1,756 |

| Mobile | 25% | $12,453 | 35% | $20,677 |

| Display-related | ||||

| – Digital Video Commercials | 7% | $3,254 | 7% | $4,236 |

| – Ad banners / display ads | 16% | $8,049 | 13% | $7,745 |

| – Sponsorships | 2% | $774 | 1% | $649 |

| – Rich media | 3% | $1,410 | 2% | $1,251 |

| Total display-related | 27% | $13,487 | 23% | $13,881 |

| Revenue (Pricing Models) | ||||

| Impression-based | 33% | $16,506 | 33% | $19,942 |

| Performance-based | 66% | $32,434 | 65% | $38,644 |

| Hybrid | 1% | $511 | 2% | $966 |

The survey includes data concerning online advertising revenues from Web sites, commercial online services, free email providers, and other companies selling online advertising. The full report is issued twice yearly for full- and half-year data, and top-line quarterly estimates are issued for the first and third quarters. PwC does not audit the information and provides no opinion or other form of assurance with respect to the information.

A copy of the full report is available at iab.com/internetadrevenue.

About PwC US

At PwC US, our purpose is to build trust in society and solve important problems: “We’re a network of firms in 157 countries with more than 208,000 people who are committed to delivering quality in assurance, advisory, and tax services.” Find out more and tell us what matters to you by visiting us at www.pwc.com/us.

© 2016 PwC. All rights reserved. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details.

About IAB

The Interactive Advertising Bureau (IAB) empowers the media and marketing industries to thrive in the digital economy. It is comprised of more than 650 leading media and technology companies that are responsible for selling, delivering, and optimizing digital advertising or marketing campaigns. Together, they account for 86 percent of online advertising in the United States. Working with its member companies, the IAB develops technical standards and best practices and fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. The organization is committed to professional development and elevating the knowledge, skills, expertise, and diversity of the workforce across the industry. Through the work of its public policy office in Washington, D.C., the IAB advocates for its members and promotes the value of the interactive advertising industry to legislators and policymakers. Founded in 1996, the IAB is headquartered in New York City and has a West Coast office in San Francisco.