WSJ Digital Networkは、Rubicon Projectと共に、「WSJ AUDEX」というプライベートエクスチェンジを発表

In yet another sign that major publishers are embracing real-time bidding, The Wall Street Journal Digital Network has teamed up with The Rubicon Project to launch its first branded private ad exchange called “WSJ AUDEX.”

The invitation-only exchange will allow select advertisers and marketers access to the WSJ Digital Network’s first-party data across its flagship site, WSJ.com, along with MarketWatch, Barrons, and SmartMoney. (For now, the WSJ’s Dow Jones sibling, media and tech blog AllThingsD, will not have its inventory included in the private exchange, a rep said.)

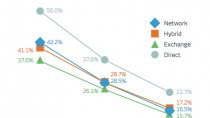

The rise of RTB in the past few years has tended to exacerbate fears on the part of larger, traditional brands that digital advertising in general has eroded direct, premium sales by encouraging marketers and agencies to “cherry-pick” audiences at demonstrably lower prices through ad networks and exchanges.

But as Michael Rooney, WSJ’s chief revenue officer, and Mark Fishkin, VP, digital sales and marketing at the WSJ Digital Network, told AdExchanger, their private exchange is designed to introduce them to new advertisers – particularly female-focused consumer packaged goods marketers like Procter & Gamble – and ultimately lead to full direct sales relationships.

A few months ago, the WSJ issued an RFP for a supply-side platform to help design and power a private exchange, Rooney said in an interview ahead of the official announcement on Wednesday.

“The timing is just right for us, as the number of digital platforms we’re on is growing and so is our digital audience, particularly women and younger consumers,” Rooney says, citing a 2012 Ipsos Mendelsohn Affluent Survey that said that the WSJ’s print and online franchise reaches more affluent women (with household income of over $200,000) than rival New York Times does Mondays to Fridays. “Robert Thomson [editor-in-chief of WSJ parent Dow Jones and the paper’s managing editor] has set up an integrated digital and print operation for the editorial side, while we’ve done the same on the ad side.”

With more and more and advertisers and agencies funneling their ad buying through trading desks and demand side platforms, Rooney and Fishkin say that not only can they protect and eventually boost traditional direct sales methods, but the exchange process can buttress premium buys by using WSJ AUDEX to manage its own audience segments through categories such as insurance and technology.

“You’re not going to see ‘garbage’ inventory from us on the exchange,” Rooney said. “If we’re going to play in the exchange space, we want to play correctly. We’re going to place quality inventory on AUDEX, but with very tight controls. We believe that a major marketer who hasn’t necessarily looked at the WSJ before, thinking that we’re a strictly financial, business professional play, might want to reach younger men through our RTB environment. Once they see what we can deliver, they may want to take a closer look at what else we can do.”

Aside from using AUDEX to generate leads, the WSJ also wants to generate revenue. At the same time, Rooney and Fishkin spoke about the need to carefully balance that directive with a layer than ensures clear thresholds for pricing and the kinds of audiences and sites available. “The special sauce that we’re putting out here is first party data driven audience segments from the data management platform we created last year,” Fishkin added. “So it’s not necessarily an index of all the possible placements that we have. The controls are not just a matter of pricing, but also, who gets to participate in our exchange.”

Praising the WSJ as “a globally recognized brand, known for their high quality content,” Frank Addante, Rubicon’s CEO and founder, added that “as advertisers and agencies are rapidly adopting automation to drive down digital ad buying operational costs and increase effectiveness, premium publishers are able to leverage technology to grow revenue by expanding the quantity and depth of advertiser relationships. We are excited that WSJ has chosen Rubicon’s real time trading platform, REVV, to provide their advertisers with automated, efficient access to their high value audience with great levels of control and protection.”

While there are big hopes that the introduction of WSJ Digital Network inventory on the exchange will draw new advertisers, Rooney also noted that it will also be available to existing ones as well. “Certain clients buy us for high-end, branding placements and they’ll come to us and say that they’re also looking for something more basic and elemental,” Rooney said. “We can offer the exchange as a relatively lower-tier product to them and extend our relationship that way too.”

To support WSJ AUDEX, the company will be working with three buying platforms, IPG’s Cadreon, Proclivity, and Vivaki’s Audience on Demand.

“We have been working closely with the WSJ team in preparation for their exchange debut,” said Teri Gallo, VP, Programmatic Practice for Mediabrands Audience Platform. “We intend to leverage WSJs real-time media assets and targetable audiences across Cadreon’s full portfolio of clients. In addition to expanding our direct premium marketplace, this partnership will provide a foundation for us extend a client’s integrated media programs with WSJ, programmatically. This is significant. It further validates that we are transforming the way in which digital media is activated; we are tightening the intersection between integrated digital and programmatic; and we are more efficiently bringing marketers and valued content owners much closer together.”

WSJ AUDEX will be open to other platforms over the next few weeks and months.

One thing that the WSJ does not plan to change as it opens its exchange is that it will continue to avoid ad networks. “We’ve stayed away from networks because we’re sensitive to the brand,” Rooney said. “And the ability to control what is available to be bidded on, in comparison to what happens within third party ad networks, makes what we’re doing now with AUDEX even more attractive to the sales team here.”