Facebook Exchangeがさらなる検索結果情報を狙う

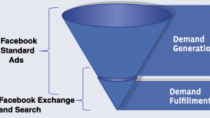

Last month we noted that search intent data had come to the Facebook Exchange, in the form of a partnership with search retargeter Chango. The deal represented something of an incursion by Facebook on terrain that’s long been lucrative for Google.

Last month we noted that search intent data had come to the Facebook Exchange, in the form of a partnership with search retargeter Chango. The deal represented something of an incursion by Facebook on terrain that’s long been lucrative for Google.

Now Facebook has done it again, adding search retargeting firm Simpli.fi to the FBX partner program. Simpli.fi will compete for Facebook RTB inventory alongside traditional DSPs (Turn, DataXu, etc), retargeters (Criteo, AdRoll), avowed social ad specialists (Optim.al, Triggit), and one agency trading desk (WPP’s Xaxis).

CEO Frost Prioleau says the company does not strictly focus on search retargeting, but also site retargeting and CRM database matching.

Simpli.fi will bring significant new demand to FBX, further driving up prices in its RTB auctions. The company is in the process of migrating 5000 already live campaigns to FBX. For those campaigns it provides full price transparency, disclosing “actual media, data, and platform costs” to clients. No arbitraging of media or data – strictly licensing fees.

Adding a second search retargeter is consistent with Facebook’s preferred approach of loosing a thousand arrows and hoping a few of them hit the target. The FBX program now stands at some 15 companies – though not all are yet listed on the PMD page. The company is clearly betting that by introducing as many new sources of demand as possible, ad prices ad bid activity on the exchange will rise.

The risk for advertisers and FBX partners is that the steady influx of vendors combined with rising prices will hinder the value proposition associated with FBX, which has until now been lauded for low price relative to performance (i.e. strong ROI). It would seem inevitable that the low hanging fruit on FBX will eventually move higher in the tree as multiple bidders try to stake a claim on each of its 7 billion-plus rumored daily impressions.

What comes after the gold rush? We may be about to find out.